Introduction

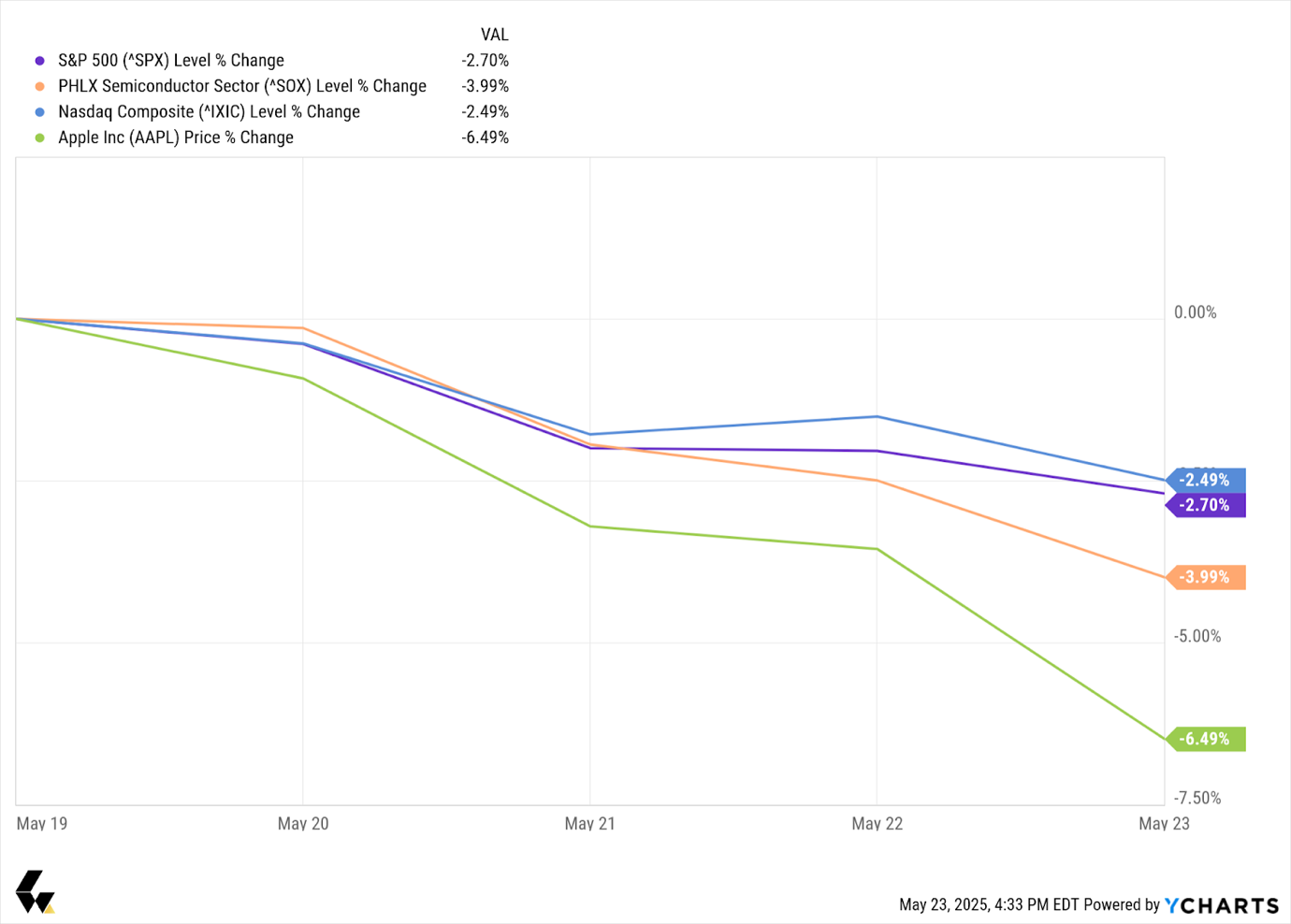

This week, major U.S. equity benchmarks extended their pullback amid political and trade uncertainties. Over the past five trading days, the Dow Jones Industrial Average fell 2.47%, the S&P 500 declined 2.61%, and the Nasdaq Composite slid 2.47%. Small caps underperformed—the Russell 2000 was down 3.47%—while the Utilities sector saw a relatively mild 0.70% drop, and the Nasdaq Biotech index bucked the trend with a 0.46% gain.

The medium-term outlook is shaped by two major developments this week: internal Republican divisions over Trump’s proposed tax-cut package and renewed tariff threats tied to his 'America First' agenda.

Quantel Asset Management’s recommendations

Building a well-diversified portfolio involves balancing short-term hedging and tactical sector opportunities with a strategic focus on long-term positioning. In the short term (30% of the portfolio), shift allocations toward gold and long-duration Treasuries to help reduce volatility, while increasing exposure to defensive sectors like utilities, consumer staples, and targeted healthcare sub-sectors. Tactical opportunities in financials, industrials, and domestic manufacturing, especially in light of potential tax cuts and ongoing reshoring trends, can be explored. At the same time, targeted investments in technology hardware firms with flexible supply chains can offer upside potential.

For the long term (70% of the portfolio), focus can be on advanced technology enablers such as AI, automation, and robotics firms, while also maintaining exposure to the energy and materials sectors, with careful attention to tariff-related risks. Adopt a cautious approach toward consumer discretionary, especially imported goods, while placing greater emphasis on domestically produced brands. Keeping abreast of legislative timelines, tariff changes, and Federal Reserve policy will be essential for effective risk management and adjusting strategies.

1. House Clears ‘One Big Beautiful Bill Act’ After Concessions, Markets React

Stocks dipped midday as rising Treasury yields and renewed doubts over the fate of a broad tax-cut package rattled investors on Wednesday.

Rare Overnight Hearing Reveals GOP Rift

In a highly unusual move, the House Rules Committee convened at 1 a.m. EDT to debate the so-called “big, beautiful bill,” highlighting deep divisions within the Republican Conference. Hard-liners in the House Freedom Caucus have stalled progress—demanding sharper rollbacks of green-energy credits and stricter spending offsets for Medicaid and SNAP—while members from high-tax coastal states push to raise the SALT deduction cap from $10,000 to $30,000. With both sides locked in disagreement, Speaker Mike Johnson acknowledged a full-house vote might slip past Wednesday.

Narrow Passage & Market Response

On May 22, 2025, the U.S. House passed the One Big Beautiful Bill Act by a 215–214–1 vote—securing support through last-minute concessions that raised the SALT deduction cap from $30,000 to $40,000 for taxpayers earning under $500,000 and accelerated Medicaid work requirements to late 2026 to win over GOP holdouts. Stocks, which had sold off amid rising Treasury yields and legislative uncertainty, steadied by Thursday afternoon as investors digested the narrow passage of bill and turned attention to the Senate’s expected revisions and the bill’s estimated $3.8 trillion impact on the federal debt.

What’s in the Bill—and Why Trump Wants It

The legislation would:

-

Extend and expand President Trump’s 2017 tax cuts for individuals and corporations.

-

Introduce new breaks on tips and overtime pay.

-

Boost SALT deductions to a $30,000 cap.

-

Tighten work requirements for Medicaid and SNAP recipients.

-

Roll back certain green-energy tax credits.

-

Increase funding for border security and defense.

The White House defended these measures stating these will spur growth, lift household disposable incomes, and enhance U.S. corporate competitiveness.

Looking Ahead: Rally Potential vs. Debt Concerns

Analysts have highlighted that the legislative package could potentially impact the federal deficit by $3.8–5 trillion over ten years. While this has influenced bond markets and led to a credit rating adjustment by Moody’s, it is also important to consider that such investments could stimulate economic growth and have long-term benefits. Historically, similar packages have had varied impacts on the economy, balancing short term fiscal challenges with potential long-term gains. A smooth passage might spark rallies—particularly in rate-sensitive financials and industrials - but investors should brace for continued volatility as amendments and vote timing remain in flux.

2. Tariffs: Short-Term Shocks & Long-Term Ripples

President Trump’s revival of sweeping import taxes has injected fresh uncertainty into global markets. We track four key episodes and highlight where to place illustrative figures.

- 2018 Steel & Aluminum Tariffs

- Policy Snapshot: In March 2018, Trump imposed a 25% tariff on steel and 10% on aluminum under national security grounds.

- Short-Term Shock: U.S. steel prices jumped ~5% and aluminum ~10% within a month, outpacing global peers and pressuring construction and manufacturing stocks.

- Long-Term Ripples: By 2019, U.S. steel output rose 6 million MT and aluminum 350,000 MT, while mill employment climbed 6–5%. However, elevated input costs slowed downstream GDP growth through 2019.

- April 2025 “Liberation Day” Tariffs (“1.0”)

- Policy Snapshot: On April 2, Trump declared a national emergency and slapped a 10% tariff on nearly all imports effective April 5, with reciprocal rates of 11–50% on 57 partners (largely suspended hours later).

- Short-Term Shock: Equities plunged on April 3, forcing rapid tariff suspensions to calm panic.

- Long-Term Ripples: The Penn Wharton Budget Model projects a 6% hit to long-run GDP and a $22,000 lifetime wage loss per median household; higher yields crowd out private capex.

- April 2025 “2.0” Baseline Tariffs

- Policy Snapshot: A tiered scheme imposed a 10% baseline on all imports (April 5) plus country-specific levies up to 50%, later adjusted through May with selective suspensions.

- Short-Term Shock: The staggered rollout and frequent reversals drove the Economic Policy Uncertainty Index to multi-year highs.

- Long-Term Ripples: Corporates accelerated near-shoring and “friend-shoring,” while policy volatility complicated long-term planning.

- May 2025 EU & iPhone Tariffs

- Policy Snapshot: On May 23, Trump threatened 50% duties on EU goods (effective June 1) and 25% tariffs on iPhones unless Apple shifts production stateside.

- Short-Term Shock: Apple shares plunged ~3%, dragging semiconductor suppliers lower as funds rotated into Treasuries and gold.

- Long-Term Ripples: Prolonged levies could fracture tech supply chains—accelerating assembly relocation to India, Vietnam, and Mexico—and provoke EU retaliatory duties on U.S. agri-exports.

3. Synthesis & Strategic Takeaways

30% of Portfolio: Short-Term Hedging & Tactical Sector Plays:

- Fixed Income & Gold: Rotate into long-duration Treasuries and gold to buffer volatility.

- Defensive Sectors: Overweight utilities, consumer staples, and select healthcare sub-industries.

- Financials & Industrials: Primed for relief rallies if tax cuts pass—consider targeted overweight.

- Domestic Manufacturing: Benefit from reshoring trends—explore ETFs or individual names with strong U.S. footprints.

- Technology Hardware: Selective exposure to companies capable of agile supply-chain shifts.

70% of Portfolio: Long-Term Positioning:

- Technology Enablers: Companies focused on AI, Automation, robotics

- Alternatives: industrial real estate assets in Mexico/Poland as potential winners.

- Energy & Materials: Monitor steel and aluminum producers in light of repeat tariff risks; favor low-cost producers.

- Consumer Discretionary: Cautious approach on goods reliant on imports; tilt toward home-grown brands and services.

Monitor Events & Manage Risks:

- Legislative Calendar: Track House/Senate vote schedules and potential amendments to tax proposals.

- Tariff Announcements: Watch White House communications for new levies or suspensions.

- Fed Policy: Let tariff-driven inflation data inform rate path expectations; adjust duration and yield curve exposure accordingly.

4. Addendum

Sources

- Reuters; USA TODAY; Reuters; Wikipedia; Penn Wharton Budget Model; Trade Compliance Resource Hub; NPR; WSJ; Bloomberg

EXPLORE MORE POSTS

The Executive guide to Diversifying Concentrated Stock

For many executives and founders, company stock represents both professional...

Read Moreby Irman Singh

AI Meets Reality: Labor Cracks, Fed Uncertainty, and a Market in Reset

The U.S. equity market has taken a sharp turn this week as investors react to...

by Jerry Yuan

Where AI Truly Helps RIAs (and Where It Doesn't) : A PRACTICAL GUIDE

by Irman Singh

Gold & Silver Surge: A Quiet Warning Signal for U.S. Equity Markets

Gold and silver are surging as U.S. stocks show volatility, signaling a shift...

by Jerry Yuan

Portfolio Construction Mistakes Advisors Must Avoid in 2026 -PART 2

by Irman Singh

Markets Bounce Back as Trump Blinks — Relief Rally Returns, but Caution Lingers

US markets staged a sharp relief rally after President Trump paused planned...

by Jerry Yuan

Portfolio Construction Mistakes Advisors Must Avoid in 2026 -PART 1

by Irman Singh

U.S.–Taiwan Trade Deal: A Structural Positive for U.S. Equities

The U.S.–Taiwan trade agreement represents a substantial benefit for U.S....

by Jerry Yuan

AI for RIAs: Portfolio Management, Client Experience & Compliance

by Irman Singh

Energy Politics vs. Market Reality: What Venezuela Means for U.S. Equities

by Jerry Yuan

Strategic Planning for RIAs 2026 -the Next Phase of Growth

A look at RIA industry trends, digital transformation, and long-term firm...

Read Moreby Irman Singh

2026 Investement Outlook: Strategic Priorities for Investors

As we approach 2026, ultra-high-net-worth (UHNI) investors face a landscape...

Read Moreby Irman Singh

2025 The year that was: Trump Tariffs, Gold Rally, and Portfolio Positioning for Investors

As we close the books on 2025, we reflect on a year that tested investors'...

Read Moreby Irman Singh

U.S. Equities Rebound as Cooling Inflation Strengthens Fed Pivot Expectations

Cooling inflation has revived confidence in U.S. equities, with falling yields...

Read Moreby Jerry Yuan

Jurisdictional Complexity: Managing Multi-Country Income and Tax Exposure.

by Irman Singh

Why Oracle’s Pullback Doesn’t Signal the End of the AI Trade

Oracle’s sharp post-earnings selloff triggered a broad AI market pullback, but...

Read Moreby Jerry Yuan

Investment Risk Profile: Factors Affecting It and Tax Strategy

Every investor has a unique investment risk profile, which determines how much...

Read Moreby Irman Singh

BOJ Tightening: How Japan’s Rate Hike Could Impact U.S. Equities

Japan’s shift toward tightening has added volatility to global markets, but...

Read More