Japan’s shift toward tightening has added volatility to global markets, but structural support from U.S. growth, disinflation, and pending Fed easing is keeping risks contained. Unless Japanese yields or the yen move sharply, U.S. equities should navigate the turbulence and maintain a constructive setup into early 2026.

Japan’s Policy Shift Sends Global Markets Reeling

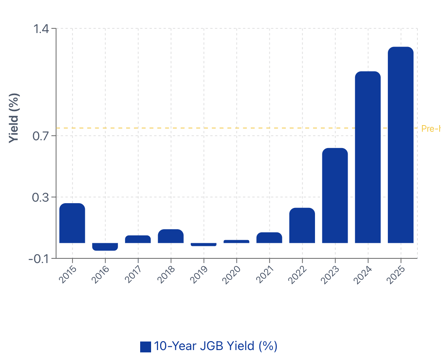

The U.S. stock market is under pressure this week as the Bank of Japan’s move on a possible December rate hike rattles markets worldwide. Japanese government bond yields have climbed to their highest levels since 2007, with the 10-year JGB approaching 1.93%, reflecting growing confidence that the BOJ will raise its policy rate to 0.75%. For a country that kept rates near zero for more than two decades, this shift represents a meaningful tightening in global financial conditions. Governor Ueda’s remarks that the BOJ will evaluate the “pros and cons” of a hike were interpreted as a signal of intent, immediately lifting global yields and tightening liquidity at the margin.

Impact of Rising Japanese Yields on U.S. Equities

Two mechanisms have driven the U.S. market’s reaction. First, higher Japanese yields reduce the relative attractiveness of U.S. assets, pushing the U.S. 10-year Treasury yield back above 4.1% and weighing on long-duration equities. Second, the prospect of a stronger yen has revived concerns about a partial unwind of yen-funded carry trades, a primary funding channel for global risk assets over the past decade. While the moves are far smaller than the August 2024 episode, the sensitivity of crypto, FX, and high-beta equities to these shifts shows how central Japanese liquidity remains to the broader market ecosystem.

Why a Disorderly Shock Remains Unlikely

For now, the risk of a sudden shock is small. Japanese investors are still purchasing foreign bonds, and lower hedging costs should keep their overseas flows steady. Japan’s policymakers have also emphasized that real rates remain negative, suggesting that even with a hike, financial conditions will remain accommodative. These factors help explain why global markets have experienced volatility, but not panic.

Supportive U.S. Macro Conditions Amid BOJ Tightening

In the U.S., the macro backdrop remains supportive. Disinflation is progressing, wage pressures are moderating, and markets are pricing in a high likelihood of a Fed rate cut next week. Equity sentiment is more fragile after a strong November performance, but underlying fundamentals—corporate earnings resilience, improving real incomes, and a potential Fed easing cycle—continue to anchor medium-term outlooks.

Near-Term Volatility, Constructive Outlook for 2026

In the coming weeks, U.S. equities are likely to stay volatile as markets assess the BOJ’s December 18–19 meeting and the Fed’s policy signals. However, unless Japanese yields break decisively above 2% or the yen appreciates in a disorderly way, any spillover into U.S. risk assets should remain contained. Overall, the U.S. macro backdrop—stabilizing growth, easing inflation, and gradually more accommodative policy—supports a constructive start heading into 2026.

Key Takeaways

-

Risks to watch: Japanese 10-year yields surpassing 2%, disorderly yen appreciation

-

U.S. equities outlook: Likely resilient amid global volatility

-

Macro drivers: Stabilizing growth, moderating inflation, potential Fed easing

EXPLORE MORE POSTS

Portfolio Construction Mistakes Advisors Must Avoid in 2026 -PART 2

by Irman Singh

Markets Bounce Back as Trump Blinks — Relief Rally Returns, but Caution Lingers

US markets staged a sharp relief rally after President Trump paused planned...

by Jerry Yuan

Portfolio Construction Mistakes Advisors Must Avoid in 2026 -PART 1

by Irman Singh

U.S.–Taiwan Trade Deal: A Structural Positive for U.S. Equities

The U.S.–Taiwan trade agreement represents a substantial benefit for U.S....

by Jerry Yuan

AI for RIAs: Portfolio Management, Client Experience & Compliance

by Irman Singh

Energy Politics vs. Market Reality: What Venezuela Means for U.S. Equities

by Jerry Yuan

Strategic Planning for RIAs 2026 -the Next Phase of Growth

A look at RIA industry trends, digital transformation, and long-term firm...

Read Moreby Irman Singh

2026 Investement Outlook: Strategic Priorities for Investors

As we approach 2026, ultra-high-net-worth (UHNI) investors face a landscape...

Read Moreby Irman Singh

2025 The year that was: Trump Tariffs, Gold Rally, and Portfolio Positioning for Investors

As we close the books on 2025, we reflect on a year that tested investors'...

Read Moreby Irman Singh

U.S. Equities Rebound as Cooling Inflation Strengthens Fed Pivot Expectations

Cooling inflation has revived confidence in U.S. equities, with falling yields...

Read Moreby Jerry Yuan

Jurisdictional Complexity: Managing Multi-Country Income and Tax Exposure.

by Irman Singh

Why Oracle’s Pullback Doesn’t Signal the End of the AI Trade

Oracle’s sharp post-earnings selloff triggered a broad AI market pullback, but...

Read Moreby Jerry Yuan

Investment Risk Profile: Factors Affecting It and Tax Strategy

Every investor has a unique investment risk profile, which determines how much...

Read Moreby Irman Singh

BOJ Tightening: How Japan’s Rate Hike Could Impact U.S. Equities

Japan’s shift toward tightening has added volatility to global markets, but...

Read Moreby Jerry Yuan

Stop Overpaying: What Every Entrepreneur Should Know About Tax Strategy

High-Net-Worth entrepreneurs manage complex financial lives—multiple ventures,...

Read Moreby Irman Singh

Top 5 Tax-Efficient Strategies for Corporate Leaders in the U.S.

Corporate leaders in today’s environment face increasingly complex tax...

Read Moreby Irman Singh

Markets Under Pressure: Valuation Strains, Credit Stress, and Mixed Macro Signals Drive Volatility

Markets are showing strain across AI stocks, private credit, crypto, and global...

Read More